New Delhi: Taxpayers who missed the original Income Tax Return (ITR) filing deadline have one final opportunity to comply. 31 December is the last date to file a belated or revised income tax return under the Income Tax Act. Missing the deadline can result in higher penalties, loss of tax benefits, and restricted filing options in the future.

Belated ITR Deadline: What Taxpayers Must Know

Under Section 139(4) of the Income Tax Act, taxpayers who failed to file their return by the original due date are allowed to submit a Belated Income Tax Return.

31 December is the last date to file a belated or revised ITR for the relevant assessment year. After this date, normal filing is no longer permitted.

What Is a Belated Income Tax Return?

A Belated ITR is an income tax return filed after the original due date but within the permitted extended window.

- Ensures compliance with income tax laws

- Allows eligible refund claims

- Helps avoid notices, penalties, and scrutiny

Penalty for Filing Belated ITR

Late Filing Fee (Section 234F)

- Income above ₹5 lakh → Late fee up to ₹5,000

- Income up to ₹5 lakh → Late fee up to ₹1,000

Interest on Outstanding Tax (Section 234A)

Interest at 1% per month or part thereof is charged on unpaid tax from the original due date until the filing date.

Loss of Tax Benefits

- Business and capital losses cannot be carried forward

- Refund processing may be delayed

What Happens If You Miss the 31 December Deadline?

If you fail to file even a belated ITR by today:

- Normal and revised return filing will not be allowed

- You must file ITR-U (Updated Return)

- Additional tax of 25% to 50% will apply

- Refund claims may not be permitted

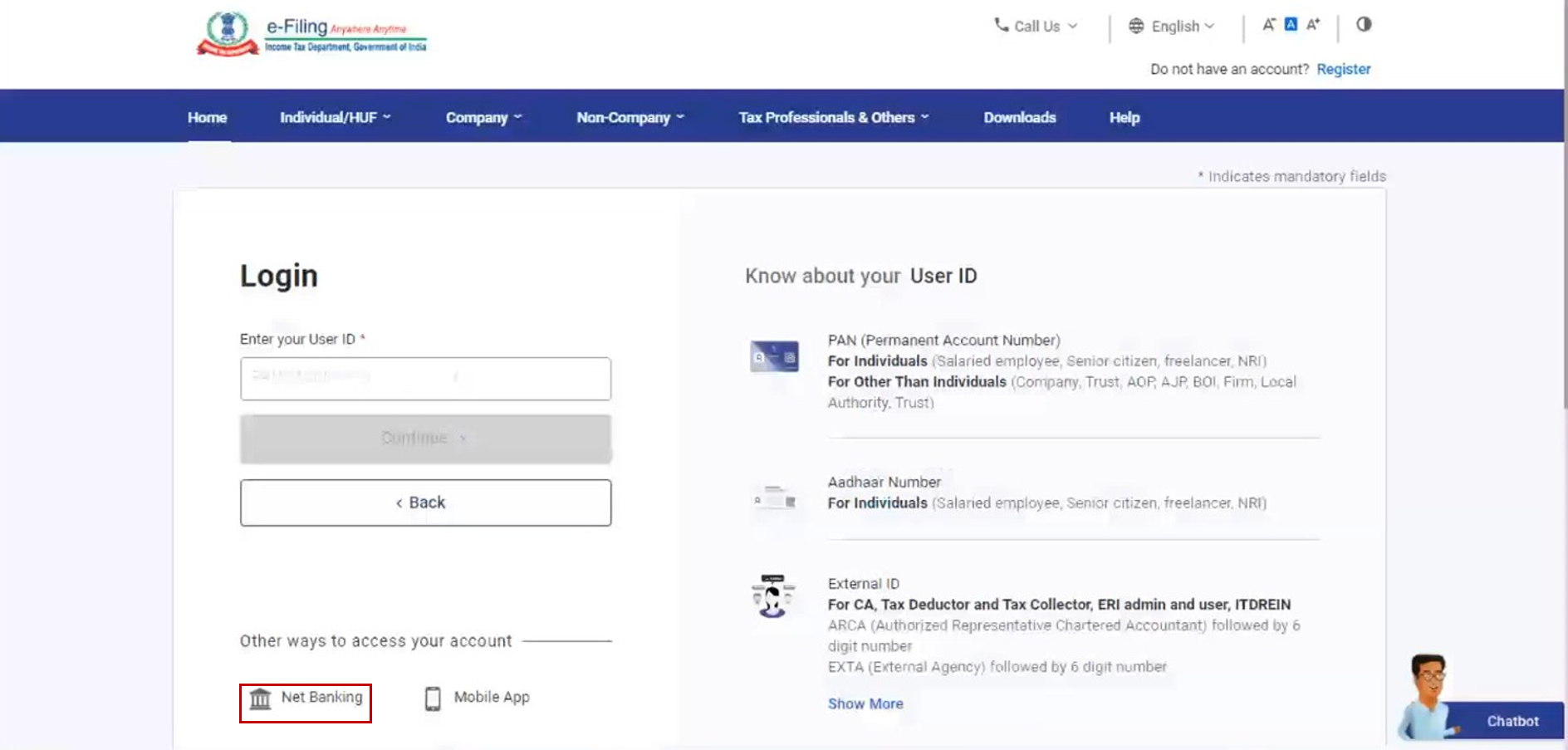

How to File Belated ITR Online Today

- Visit incometax.gov.in and log in

- Select File Income Tax Return

- Choose the correct ITR form

- Enter income, deductions, and tax details

- Pay pending tax, interest, and late fee

- Submit and e-verify immediately

Note: An unverified return is treated as invalid.

Why Filing a Belated ITR Today Is Still Important

- Avoid income tax notices and penalties

- Maintain a clean tax compliance record

- Support loan, visa, and financial applications

- Prevent higher penalties under ITR-U

FAQs on Belated ITR Filing

Can I claim a refund in a belated ITR?

Yes, refunds are allowed, though processing may take longer.

Can a belated ITR be revised?

Yes, but only until 31 December.

Is Aadhaar mandatory for e-verification?

Yes, Aadhaar-based verification is required in most cases.

Final Reminder for Taxpayers

Today is the last date to file a belated income tax return through the normal route. Filing now can help you avoid additional tax, penalties, and future compliance issues.

Taxpayers are advised to complete their filing before midnight.

Disclaimer: This article is for informational purposes only and should not be considered tax advice. Please consult a qualified tax professional for advice based on your individual circumstances.

contact for Consult - Rahul Rawat - rahulrawat8170@gmail.com