Filing the GSTR-3B correctly is a mandatory compliance for every GST-registered taxpayer in India. This monthly or quarterly self-declaration summary helps businesses report their outward supplies, ITC claims, and tax payments.

For Indian business owners and accountants, staying updated with the latest GSTR-3B filing process is essential to avoid heavy penalties. This guide provides a practical, step-by-step approach to ensuring your GST compliance is flawless and timely.

What is GSTR-3B and Who Must File It?

GSTR-3B is a simplified summary return where taxpayers declare their total tax liability for a specific period. Unlike GSTR-1, which focuses on invoice-level sales, GSTR-3B is where the actual payment of tax happens after offsetting Input Tax Credit (ITC).

Every registered person, except those under the Composition Scheme, Input Service Distributors, and Non-resident taxable persons, must file this return. Even if there are zero transactions in a month, filing a Nil GSTR-3B is compulsory to avoid late fees.

GSTR-3B Due Dates and Filing Frequency

The government offers two frequencies for filing based on your business turnover. It is critical to note that GSTR-3B cannot be revised once filed, so data accuracy is paramount.

| Taxpayer Category | Filing Frequency | Due Date |

|---|---|---|

| Turnover > ₹5 Crore | Monthly | 20th of the following month |

| QRMP Scheme (Category X States) | Quarterly | 22nd of the month following the quarter |

| QRMP Scheme (Category Y States) | Quarterly | 24th of the month following the quarter |

| Nil Return Filers | Monthly/Quarterly | Same as the respective category |

Failure to meet these deadlines results in a late fee of ₹50 per day (₹20 for Nil returns) and interest at 18% per annum on the net tax liability paid through cash.

Step-by-Step Process to File GSTR-3B Online

To begin, taxpayers must log in to the Official GST Portal using their valid credentials and follow this navigation path: Services → Returns → Returns Dashboard.

Step 1: Fill Table 3.1 - Outward and Inward Supplies

In this section, you must enter the Total Taxable Value and the breakdown of IGST, CGST, SGST, and Cess. This includes your regular sales, exports, and most importantly, Inward supplies liable to Reverse Charge (RCM).

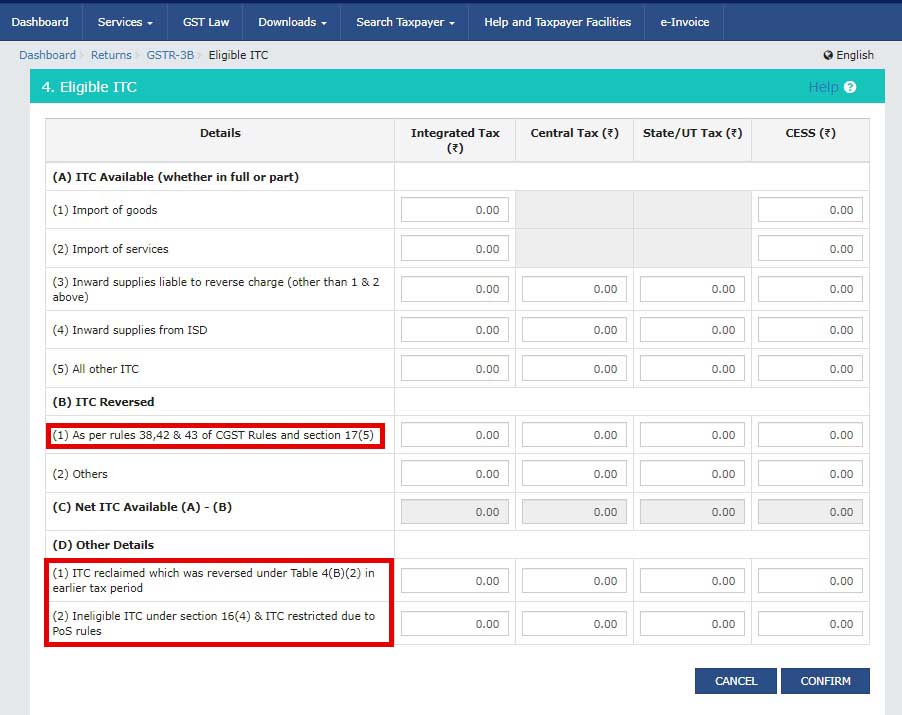

Step 2: Fill Table 4 - Eligible ITC

This is the most critical table for saving tax. You must report all Input Tax Credit available from imports and domestic purchases. Ensure that the values claimed here strictly match your GSTR-2B statement to avoid automated notices from the CBIC.

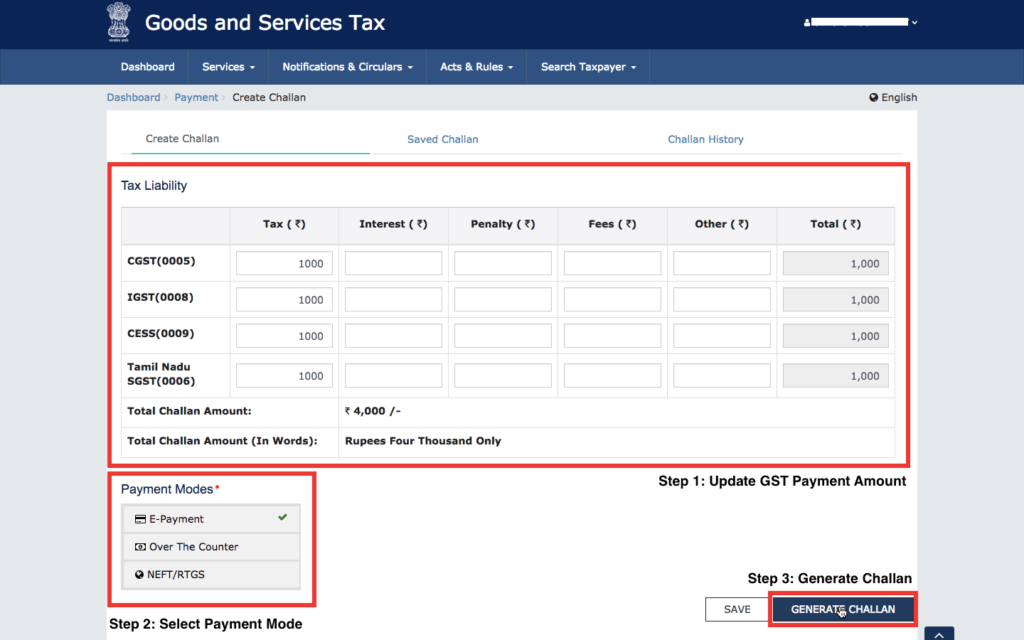

Step 3: Payment of Tax and Filing

Once the tables are filled, the system will auto-calculate your Net Tax Liability. If your ITC is insufficient, you must click on Create Challan to pay the balance via Net Banking or NEFT/RTGS. Finally, verify the return using Digital Signature Certificate (DSC) or EVC (OTP).

Related Articles from MoneyMinted.in:

Common Mistakes to Avoid in GSTR-3B

- Mismatch with GSTR-1: If your sales in 3B don't match GSTR-1, the portal may flag your account for scrutiny.

- Ignoring Blocked ITC: Claiming credit on items listed under Section 17(5) (like motor vehicles or food) is illegal and attracts penalties.

- Delaying Nil Returns: Many believe Nil returns aren't mandatory; however, late fees apply even if there is no business activity.

Frequently Asked Questions

Can I revise GSTR-3B after filing?

No, GSTR-3B cannot be revised. Any errors made in the current month must be adjusted in the return for the following month as per GST Council guidelines.

What is the maximum late fee for GSTR-3B?

The maximum late fee is capped at ₹500 to ₹5,000 per return depending on the taxpayer's turnover and tax liability, though daily accrual starts immediately after the due date.

Is it necessary to reconcile with GSTR-2B?

Yes, it is mandatory to reconcile ITC with GSTR-2B. Claiming excess ITC that does not appear in 2B can lead to the blocking of your credit ledger or tax demands.

Key Takeaways

- Always reconcile GSTR-3B with GSTR-1 and GSTR-2B before hitting the submit button.

- Ensure RCM liability is paid in cash as it cannot be settled using ITC.

- File your returns at least 2-3 days before the deadline to avoid portal congestion and last-minute payment failures.

Disclaimer

This article is for informational purposes only and does not constitute financial, tax, or legal advice. GST laws are subject to frequent changes by the GST Council. Please consult a qualified professional before making decisions.

For professional inquiries regarding MoneyMinted blog, contact us at contact@moneyminted.in