The Indian income tax system has undergone significant changes in recent years. The new tax regime has officially become the default option for taxpayers starting from Assessment Year 2025-26, offering lower tax rates but fewer deductions. Many salaried employees and individual taxpayers are now reconsidering their tax planning strategies.

This comprehensive guide explains the latest income tax slabs for FY 2025-26, compares both tax regimes, and helps you decide which option saves you more money. Understanding these changes is crucial for effective tax planning in India.

Understanding the New Tax Regime

The new tax regime under Section 115BAC provides significantly lower tax rates across income brackets. However, taxpayers forfeit most deductions and exemptions available under the old system, including 80C, HRA, LTA, and home loan interest. The Finance Act 2024 made this regime the default choice for individuals, HUFs, and certain other taxpayers.

Despite being the default, taxpayers retain the flexibility to opt for the old regime if it proves more beneficial. Salaried individuals can switch between regimes annually, while business income earners face certain restrictions on changing their choice.

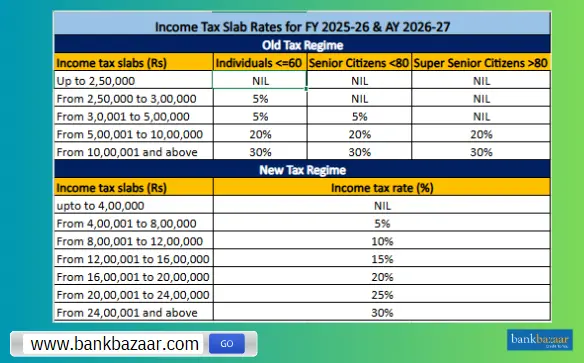

Income Tax Slabs for FY 2025-26 (New Regime)

The Union Budget 2025 introduced revised tax slabs under the new regime, effective from April 1, 2025. The basic exemption limit has been raised to ₹4 lakh, providing immediate relief to lower-income taxpayers.

| Annual Taxable Income | Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Important: A Health and Education Cess of 4% applies on the total tax liability. Additionally, surcharge rates vary based on income levels exceeding specified thresholds.

Zero Tax Up to ₹12 Lakh: Section 87A Rebate Explained

The most significant relief for middle-income taxpayers comes from the enhanced rebate under Section 87A. For FY 2025-26, the rebate limit has been increased from ₹7 lakh to ₹12 lakh, with the maximum rebate amount raised to ₹60,000 (up from ₹25,000).

This means resident individuals with taxable income up to ₹12 lakh under the new regime will pay zero income tax. When combined with the ₹75,000 standard deduction available to salaried employees, those earning up to ₹12.75 lakh annually can effectively have no tax liability.

Standard Deduction Benefits for Salaried Employees

Unlike most deductions eliminated under the new regime, salaried employees and pensioners continue to receive a standard deduction of ₹75,000 (increased from ₹50,000 in the old regime). This deduction reduces your taxable income before applying tax rates, effectively increasing your take-home salary.

The standard deduction is automatically available and requires no documentation, making it a hassle-free benefit for all salaried taxpayers and pensioners choosing the new regime.

Comparing Old and New Tax Regimes

Choosing the right tax regime depends on your income level, investment patterns, and eligible deductions. Here's a detailed comparison to help you make an informed decision.

| Feature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Tax Rates | Higher (5%, 20%, 30%) | Lower (5%-30% in gradual slabs) |

| Section 80C Deductions | Available (up to ₹1.5 lakh) | Not Allowed |

| HRA Exemption | Available | Not Allowed |

| Home Loan Interest | Available (up to ₹2 lakh) | Not Allowed |

| Standard Deduction | ₹50,000 | ₹75,000 |

| Section 87A Rebate Limit | ₹5 lakh (rebate ₹12,500) | ₹12 lakh (rebate ₹60,000) |

| Default Option | No | Yes |

| Complexity | High (requires documentation) | Simple (minimal paperwork) |

Who Should Choose the New Tax Regime?

The new tax regime is particularly beneficial for specific categories of taxpayers. Consider choosing this regime if you fall into any of these groups:

- Salaried employees with limited investments in tax-saving instruments like PPF, ELSS, or life insurance

- Individuals who do not receive HRA or LTA from their employers

- Taxpayers earning between ₹8 lakh to ₹15 lakh annually with minimal deductions

- Those who prefer simpler tax filing without maintaining extensive documentation

- Young professionals in early career stages who haven't yet built substantial investments

- Individuals without home loan obligations or major medical insurance premiums

Who Benefits More From the Old Tax Regime?

The old tax regime remains advantageous for taxpayers with significant eligible deductions and exemptions. You should consider sticking with the old regime if you have:

- Substantial 80C investments (₹1.5 lakh annually in PPF, ELSS, NSC, life insurance premiums)

- Home loan interest payments eligible for deduction under Section 24(b) up to ₹2 lakh

- HRA exemption claims covering a significant portion of your rent

- Medical insurance premiums under 80D for yourself, spouse, children, or parents

- Structured tax planning with multiple deductions under 80D, 80E, 80G, etc.

- Additional interest deduction of ₹50,000 for first-time homebuyers under Section 80EEA

Related Articles from MoneyMinted.in:

The Upcoming New Income Tax Act 2026

The Government of India has announced plans to introduce a completely overhauled Income Tax Act from April 1, 2026. This new legislation aims to simplify tax language, reduce litigation, eliminate outdated provisions, and make compliance easier for taxpayers.

While the fundamental tax structure and rates are expected to remain similar, the new Act will feature simplified language, clearer definitions, and streamlined processes. The government has indicated that this reform will reduce the complexity that has accumulated over decades of amendments to the current 1961 Act.

Key Changes in TDS Provisions for FY 2025-26

Budget 2025 also introduced significant changes to TDS (Tax Deducted at Source) provisions to reduce compliance burden:

- Increased TDS thresholds under multiple sections mean less tax deducted at source for smaller transactions

- Uniform 10% TDS rate for all resident investors on income from securitization trusts (previously 25-30%)

- Removal of Sections 206AB and 206CCA eliminates higher TDS rates for non-filers of returns

- Simplified TDS certificates and quarterly statement formats

How to Choose Between Tax Regimes

To make an informed decision, calculate your tax liability under both regimes. Follow these steps:

- Calculate your total taxable income including salary, interest, capital gains, and other sources

- List all eligible deductions and exemptions under the old regime (80C, 80D, HRA, home loan interest)

- Compute tax under old regime after applying all deductions

- Compute tax under new regime using revised slabs with ₹75,000 standard deduction

- Compare final tax amounts and choose the regime with lower tax liability

- Remember: Salaried individuals can change their choice every year

Important Deadlines for FY 2025-26

Mark these critical dates in your calendar to avoid penalties and stay compliant:

- 31 July 2026 – Last date for filing ITR for FY 2025-26 (for individuals not requiring audit)

- 31 October 2026 – Last date for filing ITR requiring audit

- 31 December 2026 – Last date for filing belated or revised returns

- 15th of every month – Advance tax installment dates (if applicable)

Frequently Asked Questions

Is the new tax regime mandatory for all taxpayers?

No, the new regime is not mandatory. While it is the default option, taxpayers can opt for the old regime when filing their income tax return. Salaried individuals can change their choice every year.

Can I switch between tax regimes every year?

For salaried individuals: Yes, you have the flexibility to switch between old and new regimes annually based on which saves more tax. For business income earners: Once you choose the new regime, you can switch back to the old regime only once during your lifetime.

Is HRA exemption available in the new tax regime?

No, HRA (House Rent Allowance) exemption is not available under the new tax regime. If you receive significant HRA benefits, calculate whether the old regime with HRA exemption saves more tax than the new regime's lower rates.

Which regime offers more tax savings?

There is no universal answer – it depends entirely on your income level, investments, and eligible deductions. Generally, if your 80C investments plus other deductions exceed ₹2.5-3 lakh, the old regime may be better. Always calculate both scenarios before deciding.

Can I claim standard deduction in the new regime?

Yes, the ₹75,000 standard deduction is available for salaried employees and pensioners even in the new tax regime. This is one of the few deductions retained in the simplified system.

Key Takeaways

- New tax regime is now the default option but switching to old regime remains possible

- Zero tax liability for income up to ₹12 lakh under new regime (₹12.75 lakh for salaried with standard deduction)

- New regime offers lower tax rates but eliminates most deductions except ₹75,000 standard deduction

- Old regime remains beneficial for taxpayers with substantial 80C investments, HRA, and home loans

- Salaried individuals can change regimes annually, while business income earners face restrictions

- Calculate tax under both regimes before making your choice – the optimal regime varies by individual circumstances

- New Income Tax Act 2026 will further simplify tax compliance and language

Disclaimer

This article is for informational purposes only and does not constitute financial, tax, or legal advice. Tax laws and provisions are subject to change by the government. Readers are strongly advised to consult a qualified tax professional or chartered accountant before making any tax planning decisions or choosing between tax regimes.

For professional inquiries regarding MoneyMinted blog content or tax consultation, contact us at contact@moneyminted.in