GSTR-1 filing is a mandatory GST compliance used to report all outward supplies made by a registered taxpayer. Any mistake in this return directly affects the buyer’s GSTR-2B and may block eligible input tax credit.

This guide explains GSTR-1 filing step by step in simple language for Indian business owners, accountants, and first-time GST filers.

What is GSTR-1 and Why It Matters

GSTR-1 is a monthly or quarterly GST return that captures invoice-wise details of sales made during a tax period. The GST system auto-populates buyer ITC based on this return.

According to the Central Board of Indirect Taxes and Customs, incorrect reporting in GSTR-1 may lead to ITC mismatch, notices, and penalties.

Who Needs to File GSTR-1

All regular GST-registered taxpayers making outward supplies must file GSTR-1. Filing frequency depends on annual turnover.

| Annual Turnover | Filing Frequency |

|---|---|

| Above ₹5 Crore | Monthly |

| Up to ₹5 Crore | Quarterly (QRMP Scheme) |

The GST Network publishes due dates and updates through official notifications on gst.gov.in.

Step-by-Step Process to File GSTR-1

- Login to the GST portal using valid credentials

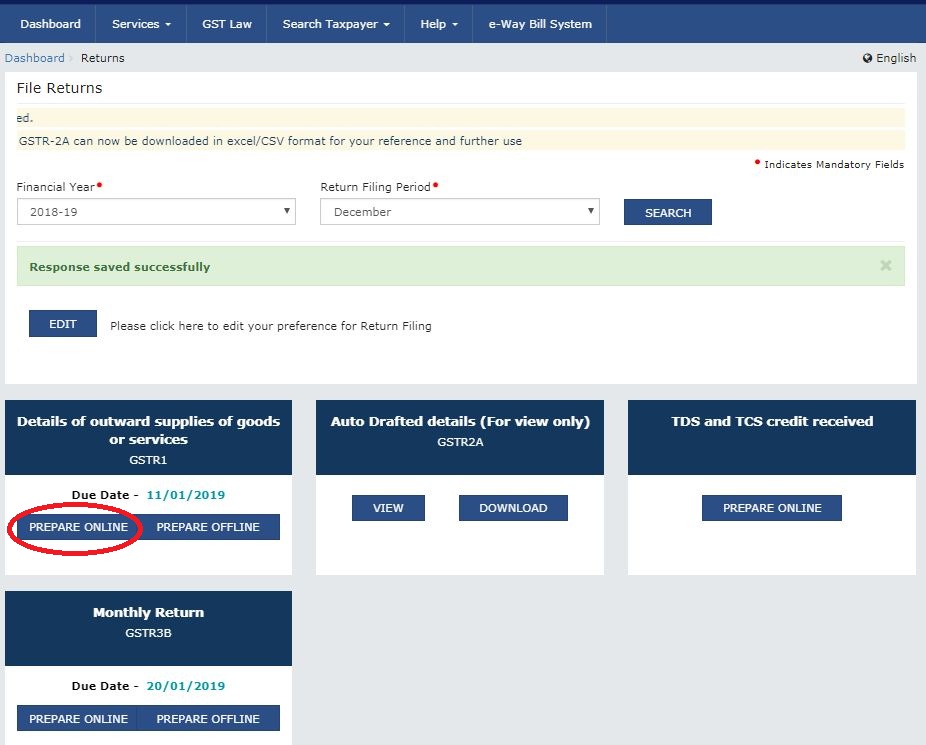

- Navigate to Services → Returns → Returns Dashboard

- Select financial year and return period

- Click Prepare Online under GSTR-1

The GST portal workflow is governed by rules notified by the Ministry of Finance.

Invoice Reporting Sections Explained

GSTR-1 requires invoice-level reporting under different tables based on customer type and transaction nature.

- B2B Invoices: Sales to registered customers with GSTIN

- B2C Large: Inter-state sales above ₹2.5 lakh

- B2C Small: Retail sales below ₹2.5 lakh

- Credit/Debit Notes: Sales returns or price adjustments

Late Fees and Penalties

Late filing of GSTR-1 attracts statutory fees under GST law.

| Return Type | Late Fee |

|---|---|

| Normal Return | ₹50 per day (₹25 CGST + ₹25 SGST) |

| Nil Return | ₹20 per day (₹10 CGST + ₹10 SGST) |

The maximum late fee is capped at ₹5,000 as notified by the GST Council.

Common Mistakes to Avoid

- Incorrect GSTIN of customers

- Mismatch between GSTR-1 and GSTR-3B

- Missing invoices or duplicate entries

- Incorrect HSN codes and tax rates

Related Articles from MoneyMinted.in:

Frequently Asked Questions

Is GSTR-1 mandatory even if no sales were made?

Yes. Taxpayers must file a nil GSTR-1 if there are no outward supplies during the period.

Can GSTR-1 be revised after filing?

No. Errors can only be corrected in subsequent returns through amendments.

Does GSTR-1 affect my customer?

Yes. Incorrect filing may block your customer’s ITC in GSTR-2B.

Key Takeaways

- GSTR-1 is critical for buyer ITC eligibility

- Accurate invoice reporting avoids GST notices

- Timely filing prevents penalties and business disputes

Disclaimer

This article is for informational purposes only and does not constitute financial, tax, or legal advice. Please consult a qualified professional before making decisions.

For professional inquiries regarding MoneyMinted blog, contact us at contact@moneyminted.in